This guide is for B2B buyers importing custom-branded promotional products from China into the US and EU, with a focus on cost control, compliance readiness, paperwork, lead times, and delivery execution. If you’re buying for a seasonal campaign, the real risk isn’t unit cost — it’s missing the delivery window.

Importing China OEM promotional products into the US and EU in 2026 works best when you (1) estimate landed cost early, (2) confirm compliance scope by category and market, (3) lock the document set before production, (4) plan lead time from artwork to delivery, and (5) choose a delivery term like DDP when you want door-to-door execution.

2026 Update Box (what changed, what to do differently):

- US low-value shipments are seeing tighter enforcement and entry scrutiny, so “small shipment” does not mean “simple clearance.”

- Plan for more data consistency checks (product description, HS logic, carton weights/counts, origin info) before shipping.

- EU GPSR has moved buyers toward risk assessment + technical documentation + traceability as a default mindset.

- Compliance is now part of quoting: labeling, testing options, and document readiness can move both price and schedule.

- Duties, freight, and supply chain costs remain volatile, so landed cost modeling matters more than negotiated unit price.

- Before you request quotes, prepare: destination, delivery term preference, product category/materials, packaging, and timeline.

What changed for US and EU importers in 2026?

In 2026, import success is less about finding a “cheap factory” and more about running a disciplined import process: stable specs, consistent paperwork, and compliance-ready documentation. US buyers should expect more scrutiny on low-value and frequent shipments. EU buyers should assume stronger expectations on safety, traceability, and technical files for consumer-facing goods.

In practical terms, this changes how you plan RFQs: you want your supplier to price the product and the import reality (packaging, tests, labels, and delivery execution), not just the blank item.

What US buyers should watch in 2026 (customs, low-value shipments, duties)

US import planning matters because clearance outcomes are increasingly driven by data quality and entry readiness, not just invoice value. If your team relied on frequent small parcels, you should build contingency: more shipments may need fuller entry handling, better classification support, and extra buffer for inspections.

What tends to work best is a “one SKU, one story” approach:

- One consistent product description (across invoice, packing list, labels)

- One clear HS logic (don’t switch mid-order)

- One carton plan (counts/weights/dimensions match what you ship)

What EU buyers should watch in 2026 (product safety, traceability, documentation)

EU buyers should plan for a stronger product safety documentation and traceability mindset, especially when items will reach consumers. Even when a product looks simple, buyers may be expected to show what it is, where it came from, how it’s identified, and what safety risks were considered.

A safer practice is to treat “technical documentation” as a living folder per SKU:

-

Product identification (model/SKU, photos, materials)

-

Labeling approach (product + carton)

-

Risk screening notes (by category and intended user)

This quick comparison helps you plan the right level of paperwork and internal ownership.

| Dimension | US (2026 direction) | EU (2026 direction) | Recommendation |

|---|---|---|---|

| Customs scrutiny | Tighter review for frequent/low-value flows | More market surveillance readiness | Standardize descriptions, HS logic, and carton data |

| Documentation | Entry-ready invoice/packing accuracy | Technical file + traceability mindset | Build per-SKU document folders before production |

| Product safety | Category-driven checks (e.g., batteries) | GPSR-style safety/risk expectations | Classify risk early (electronics, food-contact, kids) |

| Labeling | Docs and carton marks must match | Clear product identification and operator info where needed | Lock label artwork and carton marks with the PO |

| Risk points | Holds from mismatch or incomplete data | Requests for technical documentation | Do not ship until docs match packed goods |

If your internal team is small, prioritize process discipline and predictable execution over “heroic last-minute fixes.”

Which promotional product categories are highest-risk for compliance and delays?

The highest-risk categories are the ones that trigger extra rules, tests, labeling expectations, or transport constraints—especially electronics, food-contact drinkware, kids-related items, and “simple” apparel that fails labeling or durability checks. The fastest way to reduce delays is to identify risk at RFQ stage and align documents, QC, and packaging to that risk.

Why promotional electronics (chargers, cables, speakers) need extra checks

Promo electronics often carry hidden complexity: mixed sub-suppliers, changing components, and shipping constraints (especially batteries). EU-facing projects may need stronger documentation (often including CE/RoHS-related evidence depending on the product type), and US importers should expect more scrutiny when product descriptions are vague.

Common pitfalls to avoid:

- Incomplete or generic declarations that do not match your model

- Component substitutions without updated documentation

- Battery-related transport misalignment (packaging, labeling, classification)

✔ True — Electronics delays usually come from component changes and paperwork mismatch

In promo electronics, the “same-looking” item can have different internals. If BOM changes, documents and labels often need updates too.

✘ False — “If the sample works, mass production will be identical”

Without a frozen BOM and measurable checks, small substitutions can change compliance and shipping outcomes.

Why drinkware and food-contact items are frequently flagged

Drinkware is often flagged because performance and safety are tied to materials and coatings. Odor, coating defects, and migration concerns are the real-world reasons buyers add tests or stricter QC. Keep it practical: ask what the material is, what coating is used, and how it’s controlled across production lots.

Why apparel (T-shirts, caps) causes “simple-looking” problems

Apparel failures are usually boring and expensive: label inconsistency, fiber-content mismatch, color drift, shrinkage, and print durability. “Looks fine” is not a spec. Your PO should lock: fabric weight, composition, size tolerance, print method, and label file.

Why kids-related promo items require special caution

If an item is marketed to children, compliance expectations rise sharply and buyers should use conservative materials, stronger traceability, and tighter QC. Even when you sell B2B, downstream use can create consumer-facing exposure.

Mini-Checklist: “Category Risk Radar (Low / Medium / High)”

- Low: basic stationery (non-electrical), tote bags (non-kids), standard lanyards

- Medium: mugs/drinkware, apparel, coated metal pens

- High: chargers/power banks/speakers, any battery item, kids-focused products

What compliance and certification proof should buyers request from a China OEM supplier?

Request proof that is specific to your SKU, your market, and your final production configuration—not generic “certificates.” In real projects, good proof looks like model-matched declarations, relevant test reports where needed, and a supplier who can keep documents aligned with final materials, labeling, packaging, and shipment paperwork.

What “CE” and “RoHS” documentation usually looks like in real projects

In EU projects, CE is not a marketing badge—it’s tied to specific product types and regulatory scopes. For electronics and EEE-related items, buyers often request declarations and/or test evidence that matches the exact model (not a “similar product”). RoHS-related proof is also scope-dependent and should match your bill of materials.

What you should see:

-

A declaration that names the product clearly (model/SKU)

-

Supporting evidence appropriate to the product category

-

Dates and scope that align with your final production version

What you should verify quickly:

-

Model matching (photos/specs line up)

-

Scope (what exactly the report covers)

-

Consistency (same product description across documents)

How to handle California Proposition 65 risk without panic

Prop 65 is best handled as risk screening and chemical/material management, not panic labeling. Many buyers start with material declarations (plastics, coatings, inks), then decide whether testing is justified based on distribution footprint and risk tolerance.

“When in doubt” workflow:

- Ask for material declarations and known substances

- Quote test options early (so it doesn’t shock the schedule later)

- Align packaging/label plan before mass production if warnings are needed

What BSCI and Sedex/SMETA help with—and what they do not

BSCI and SMETA help with social compliance and ethical trade risk. They do not prove product safety compliance, CE/RoHS scope, or chemical conformity. They’re useful for supplier selection and governance, but you still need product-specific compliance planning and QC controls.

Use this checklist to avoid requesting the wrong documents or missing the ones that actually protect clearance and compliance.

| Product type | Must-have docs | Nice-to-have | Typical lead time impact | Common mistakes |

|---|---|---|---|---|

| Promo electronics | Model-matched declarations, BOM/material statements | Battery transport info, component traceability | Medium–High | Docs don’t match final BOM |

| Drinkware | Material declaration, coating specs | Testing plan for coatings/materials | Medium | Uncontrolled coating substitutions |

| Apparel | Label file, fiber content confirmation | Colorfastness/shrinkage test options | Low–Medium | Label file not locked to PO |

| Kids-related items | Conservative material set + traceability | Third-party testing strategy | High | Marketing claims raise obligations |

Your goal is a predictable document pack per SKU. That reduces approval loops, customs questions, and last-minute rework.

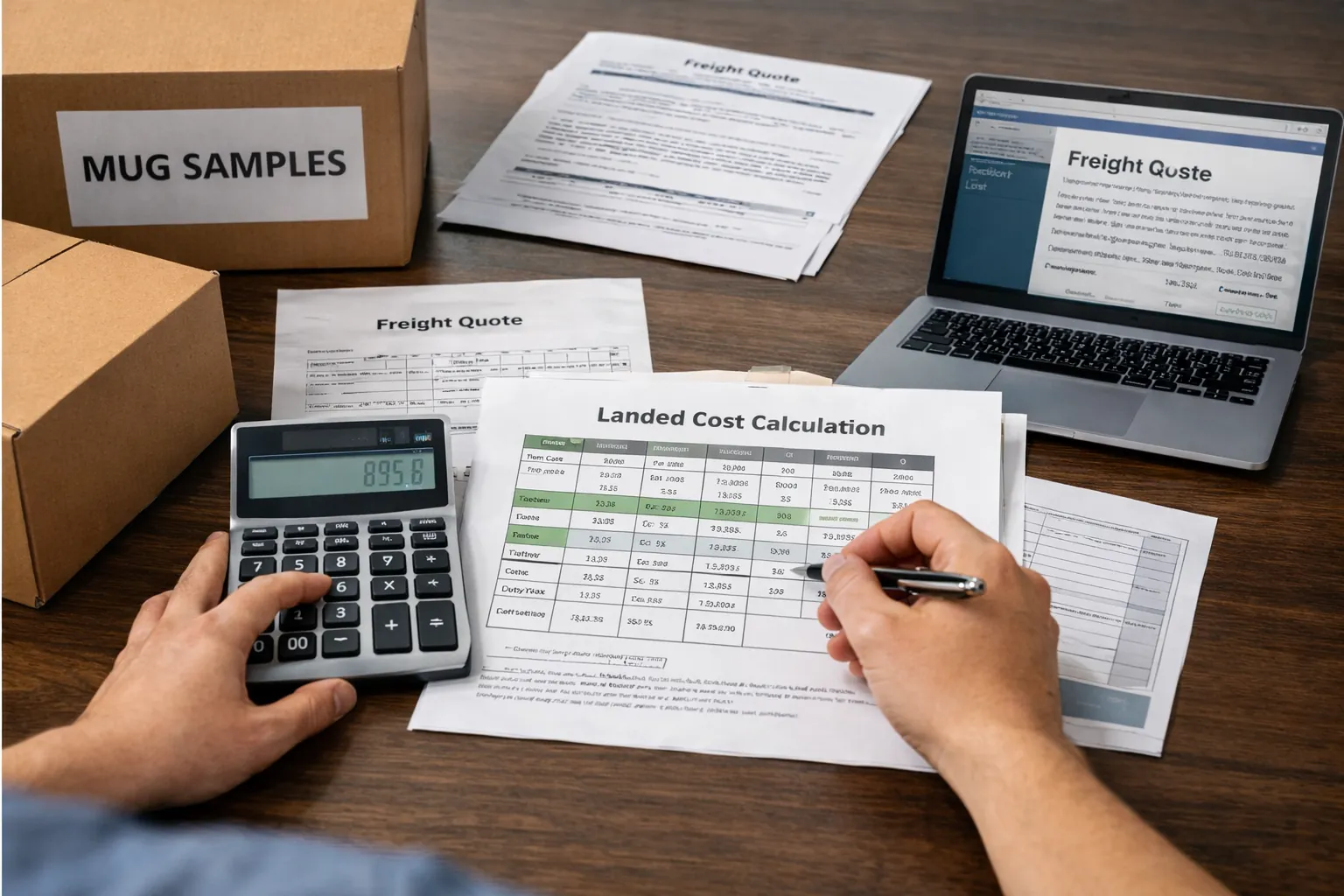

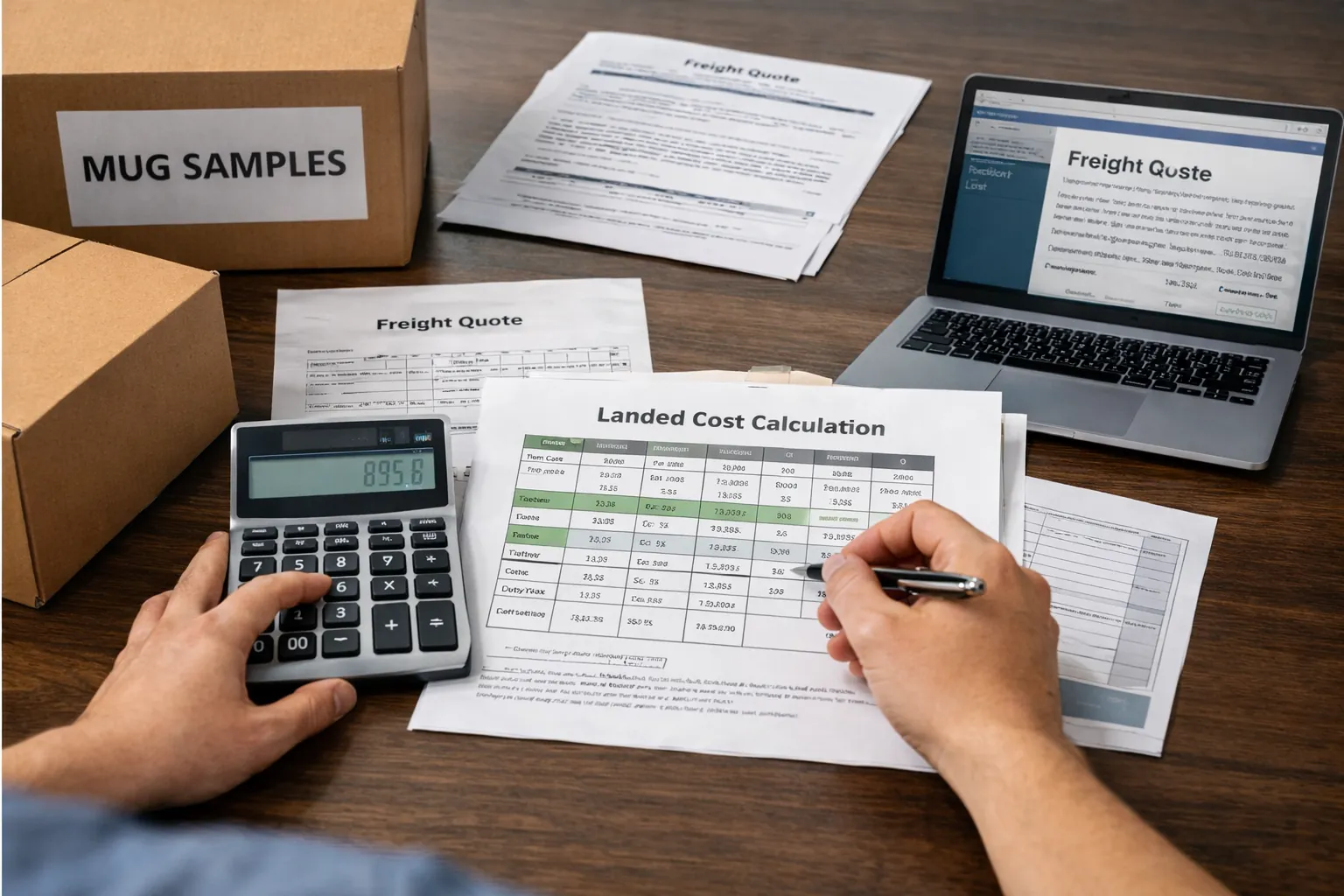

How do you calculate landed cost for China OEM promotional products?

Landed cost is your true unit cost after tooling, packaging, testing, freight, duties/taxes, clearance, and last-mile delivery. In 2026, the safest practice is to build a reusable landed-cost template and update it twice: after sample approval (spec lock) and after freight booking (carton lock).

A simple landed cost formula buyers can reuse

Reusable formula (per order):

- Unit price

- tooling/setup

- packaging/kitting

- testing/compliance costs

- freight

- duties/taxes/VAT (market-specific)

- clearance/broker fees

- last-mile delivery

Where “hidden costs” usually appear

Hidden costs usually come from changes and bottlenecks:

- Peak season surcharges or capacity premiums

- Re-labeling/repack after last-minute compliance decisions

- Storage risk when paperwork isn’t ready at arrival

One worked example

Example: 5,000 custom mugs with logo print and individual boxes

Cost buckets you should model:

-

Product + print setup

-

Individual packaging + master cartons

-

Optional testing budget (materials/coatings based on market)

-

Freight by mode (carton volume often drives cost)

-

Clearance + last-mile (especially under DDP)

This template helps you compare quotes apples-to-apples, even when suppliers present pricing differently.

| Cost bucket | What to include | When it locks | Buyer tip | Recommendation |

|---|---|---|---|---|

| Product + decoration | Unit price, setup, proof rounds | After sample approval | Lock logo method early | Use a golden sample reference |

| Packaging/kitting | Boxes, inserts, barcode labels | Before mass production | Packaging drives schedule | Approve dielines and carton marks |

| Testing/compliance | Category-driven tests and declarations | Before shipment | Quote test options upfront | Decide before production starts |

| Freight | Mode, surcharges, dimensional weight | At booking | Carton volume is money | Confirm carton dimensions early |

| Import + last-mile | Duties/taxes, clearance, delivery | Before ship under DDP | Address accuracy matters | Validate destination details |

If you want a lead magnet, this table converts cleanly into an Excel sheet with drop-downs by product category and shipping mode.

What does DDP mean, and when should buyers choose DDP vs DAP/FOB?

DDP is a delivery term where the seller takes on door-to-door responsibility to a named destination, typically including import clearance coordination and import charges in the quoted service. DAP and FOB shift more work and risk management to the buyer. Choose based on your team’s customs bandwidth and how much control you need.

DDP explained in one paragraph

DDP is the “buyer-light” option: the outcome you want is delivery to your address with fewer handoffs. In practice, you still must provide accurate product details, compliance requirements, and carton data, because the paperwork can only be correct if the inputs are correct.

DDP vs DAP vs FOB

Buyer view at a high level:

- Customs handling: DDP is mostly seller-managed; DAP/FOB require more buyer coordination

- Duties/taxes: DDP typically rolls these into the delivery service; DAP/FOB are usually paid/managed by the buyer

- Risk and handoffs: DDP reduces handoffs; DAP/FOB increase handoffs (more moving parts)

A buyer checklist to request a clean DDP quote

-

Delivery address (company, street, city, state/province, postal code)

-

Destination country/state (for tax logic and carrier selection)

-

Product category + materials (electronics? food-contact? kids?)

-

Total cartons, weights, dimensions (estimate is fine at RFQ)

-

Compliance requirements (EU/US targets, any special labeling)

Use this comparison to choose the term that matches your internal capacity, not just your unit price.

| Dimension | DDP | DAP | FOB | Recommendation |

|---|---|---|---|---|

| Import clearance | Seller-coordinated | Buyer-coordinated | Buyer-coordinated | Choose DDP if you want fewer handoffs |

| Duties/taxes | Typically built into service quote | Buyer pays/manages | Buyer pays/manages | Model landed cost before PO |

| Buyer workload | Lowest | Medium | Highest | Match Incoterm to team bandwidth |

| Control | Less broker control | More control | Most control | Use DAP/FOB if you have strong brokers |

What lead times should US and EU buyers expect for custom promo orders?

Lead time is a chain: artwork proofing → sample → mass production → shipping → delivery. The biggest schedule killers are repeated proof rounds, packaging approvals, and late compliance decisions (tests, relabeling, missing documentation). If you want a safer timeline, lock specs early and treat packaging and documents as production inputs.

Typical timeline from artwork → sample → mass production

- Proofing: depends on how fast approvals happen

- Pre-production sample: locks materials, logo method, and packaging

- Mass production: depends on category, complexity, and factory capacity

Shipping mode trade-offs (express vs air vs ocean)

-

Express: best for urgent launches, highest cost sensitivity

-

Air: balanced speed, often used when ocean is too slow

-

Ocean: best for cost efficiency, requires buffer and planning

These are planning ranges to help you set realistic internal deadlines and decision gates.

| Category | Sampling | Production | Common delay drivers | Recommendation |

|---|---|---|---|---|

| T-shirts/caps | Short | Medium | Label + size approvals | Lock label file and size chart early |

| Mugs/drinkware | Medium | Medium | Packaging and finish changes | Approve dielines and carton marks |

| Stationery | Short | Short–Medium | Color proofing revisions | Use one color standard for approvals |

| Electronics | Medium | Medium–Long | Component sourcing + documents | Freeze BOM and documentation pack |

How do you select a reliable China OEM promotional products partner?

A reliable partner is the one who can keep specs, documents, QC, and delivery execution aligned—not just offer a low unit price. In 2026, prioritize specialization, document readiness, sampling speed, communication rhythm, and delivery execution capability (including DDP if you prefer fewer handoffs).

7 questions buyers should ask

- What’s your factory specialization for this category?

- Can you show traceability by SKU/lot for key materials?

- What documents can you provide for US/EU target markets?

- How fast is sampling, and what causes delays?

- What is your weekly communication rhythm (photos, QC notes, schedule)?

- What QC plan do you run (inline + final) and what do you measure?

- Can you execute delivery (DDP/DAP/FOB) reliably to my address?

How to verify social audits without wasting time

To verify quickly, request:

-

Audit type and audit date

-

Site scope (which factory/site; not “group level”)

-

Shareability and current status

Use social audits to reduce ethical sourcing risk, then separately manage product compliance through documents, labeling, and category-appropriate testing and QC.

What is the safest first-order workflow for US & EU buyers?

The safest first order follows an 8–10 step workflow that locks specs, documents, QC, and delivery before money gets trapped in production. Treat documents and packaging as core specs, not admin. This makes landed cost more predictable, reduces customs risk, and prevents last-minute relabeling or shipping upgrades.

Step-by-step sourcing workflow

- Define specs (materials, logo method, packaging, target markets)

- Classify product risk (low/medium/high)

- Request quotes with landed-cost assumptions (shipping mode + delivery term)

- Confirm compliance plan + document checklist per SKU

- Approve artwork proofs (logo size, placement, colors)

- Approve pre-production sample (golden sample)

- Run production with inline QC checkpoints

- Final inspection + packing and carton marks confirmation

- Shipping & customs execution (DDP if chosen)

- Receiving checklist + post-order improvements for reorders

FAQ

How do I import promotional products from China to the US in 2026?

Import by aligning product specs with an entry-ready document pack, choosing a delivery term that matches your team capacity (DDP if you want fewer handoffs), and keeping descriptions and carton data consistent across invoice, packing list, and labels. Then run QC and ship only when paperwork matches packed goods.

US outcomes are usually driven by consistency. The same SKU should not change name, function description, or HS logic between quote, PO, and shipping documents. If you import frequently, build a reusable workflow: per-SKU document folders, a standard packing list template, and a pre-shipment paperwork audit. It’s also smart to keep buffer time for inspections or data corrections, especially for higher-risk categories like electronics.

How do I import promotional products from China to Europe in 2026?

Import by confirming your compliance scope early (especially safety and traceability expectations), preparing technical documentation readiness by SKU, and ensuring labeling and product identification are consistent. Start with category risk classification, then align documents, QC, and packaging before mass production.

EU buyers reduce risk by planning documentation as part of the product, not as an afterthought. Even for “simple” items, a traceability mindset matters: what the product is, what materials are used, how it’s identified, and how you can support safety questions. If you sell into multiple EU countries, standardize labeling and keep a single version-controlled technical folder per SKU.

What documents do I need to import custom promotional items?

Most shipments need a commercial invoice, packing list, stable HS logic, and origin information, plus category-specific declarations or test evidence when required. The real goal is not “more papers,” but consistent papers: your documents must describe the same product the warehouse packed.

Build a checklist per category and reuse it. Electronics and kids-related items generally need more discipline. Drinkware may need material/coating declarations and tighter QC notes. Apparel often needs label files and performance expectations. If you’re new to importing, ask your supplier to show a sample “document pack” from a similar project and confirm what will be customized to your SKU.

What does DDP mean in shipping, and is it worth it?

DDP is a door-to-door outcome where the seller takes on delivery responsibility to a named destination and typically coordinates import handling and charges within the service. It’s often worth it for first orders, tight timelines, and teams without strong customs resources.

DDP reduces handoffs, which reduces the number of places a shipment can stall. The trade-off is control: you may have less broker visibility than with DAP/FOB. The buyer-safe move is to request a clean DDP quote with complete inputs: destination address, product category/materials, compliance targets, and estimated carton data. If any of those is missing, DDP becomes “guesswork pricing.”

DDP vs DAP: which is safer for first-time importers?

For first-time importers, DDP is often safer operationally because it reduces customs coordination work and handoffs. DAP can be fine if you already have a trusted broker and internal process, but it adds coordination steps that commonly create delays on early orders.

The best choice depends on your team. If your priority is a smoother first order, choose fewer moving parts. If your priority is broker control and you’re comfortable managing duties/taxes and clearance steps, DAP can fit. Either way, you still need consistent documents and carton data. Incoterms don’t replace data quality.

Do promotional products need CE marking in the EU?

Some do and some don’t—CE depends on the product type and applicable EU rules, not on whether the item is “promotional.” Many basic non-electrical promo items won’t be CE products, but electronics and certain regulated categories often require stronger conformity documentation.

The safest approach is product-by-product screening. Ask: is it electrical/electronic, does it have radio functions, does it include batteries, and what directives/regulations typically apply? Then request model-matched documentation for your SKU and confirm labeling expectations early. Avoid “factory has CE” language; focus on “this model has the right evidence.”

Which promo electronics need RoHS compliance?

Many electrical and electronic promo items may need RoHS-related substance compliance evidence when placed on the EU market, especially powered devices and items with electronic components. Typical examples include chargers, power banks, speakers, and USB-powered gadgets with circuit boards.

RoHS proof is only useful if it matches your final BOM. If the factory sources components from multiple sub-suppliers, insist on BOM stability and a change-control process. A buyer-friendly method is to freeze the BOM at sample approval and require written approval for substitutions. That single practice prevents most “same-looking but different inside” compliance headaches.

Do I need to worry about California Proposition 65 for promo items?

If your promo items will be distributed or sold in California, Prop 65 is a real risk-screening topic—especially for plastics, coatings, inks, and metal components. The practical approach is to start with material declarations, then decide whether testing or warnings are needed based on product risk and distribution footprint.

Prop 65 is often a workflow problem, not a labeling problem. Late decisions create relabeling, repacking, and missed ship dates. If you suspect exposure, price test options early and align packaging plans before mass production. If you do need warnings, standardize the label format across your SKUs so your warehouse and documents stay consistent.

Are BSCI and Sedex the same thing?

They’re related but not the same: BSCI is a social compliance system, while SMETA is a widely used audit methodology often shared via Sedex. Both help manage ethical trade and labor-condition risk, but they do not prove product safety compliance or market-specific conformity.

Treat them as supplier governance tools. Verify audit scope (which site), recency, and shareability. Then separately manage product compliance with category-specific documentation, labeling plans, and QC measurements. Buyers get into trouble when they treat social audits as a substitute for product documentation and testing strategy.

What is a realistic MOQ for OEM promotional products?

MOQ depends on product category, decoration method, and packaging/kitting complexity—there is no one safe number. Many factories can do lower MOQs for simple items, but complex packaging, multiple SKUs, or electronics often push MOQs higher to protect yield and setup cost.

A buyer-friendly way to negotiate MOQ is to adjust variables: simplify packaging, reduce color variations, standardize logo methods, or bundle quantities across similar SKUs. If you need a low MOQ for a pilot, ask for a costed MOQ ladder (e.g., pricing at 500/1,000/3,000) and choose the point that makes landed cost sensible.

How can I reduce the risk of quality issues after sample approval?

Reduce risk by turning the sample into a measurable golden standard and enforcing change control: freeze materials and key specs, define measurable QC checks, and require written approval for substitutions. Then verify by inspection checkpoints and packing confirmation before shipment.

Most “post-sample surprises” come from undocumented substitutions or unmeasured quality. Ask for a simple spec sheet (photos + dimensions + materials + logo method + packaging) and attach it to the PO. Then run inline inspection for early detection and final inspection to confirm packing, labels, and carton marks. Packaging alignment is critical, because it affects both product damage and customs paperwork consistency.

Conclusion

Your safest 2026 import plan is a short checklist: classify product risk, confirm US/EU compliance targets, agree the document pack, estimate landed cost, lock QC checkpoints, choose the right delivery term, and freeze a timeline that includes approvals. If any of these stays “TBD,” you’ll likely pay in rework, relabeling, or shipping upgrades.

You might also like — Custom Can Coolers from China: A Complete Sourcing and Buying Guide for B2B Buyers